What Does Inflation Mean To You?

The IRS released its tax changes for 2022.* The standard deduction, gift exclusions, estate exclusions, 401(k) contribution limits, and many other amounts increase. The income ranges for federal income tax brackets will increase as well. This may sound like great news for taxpayers; however, the tax changes for 2022 are adjustments for rising inflation.

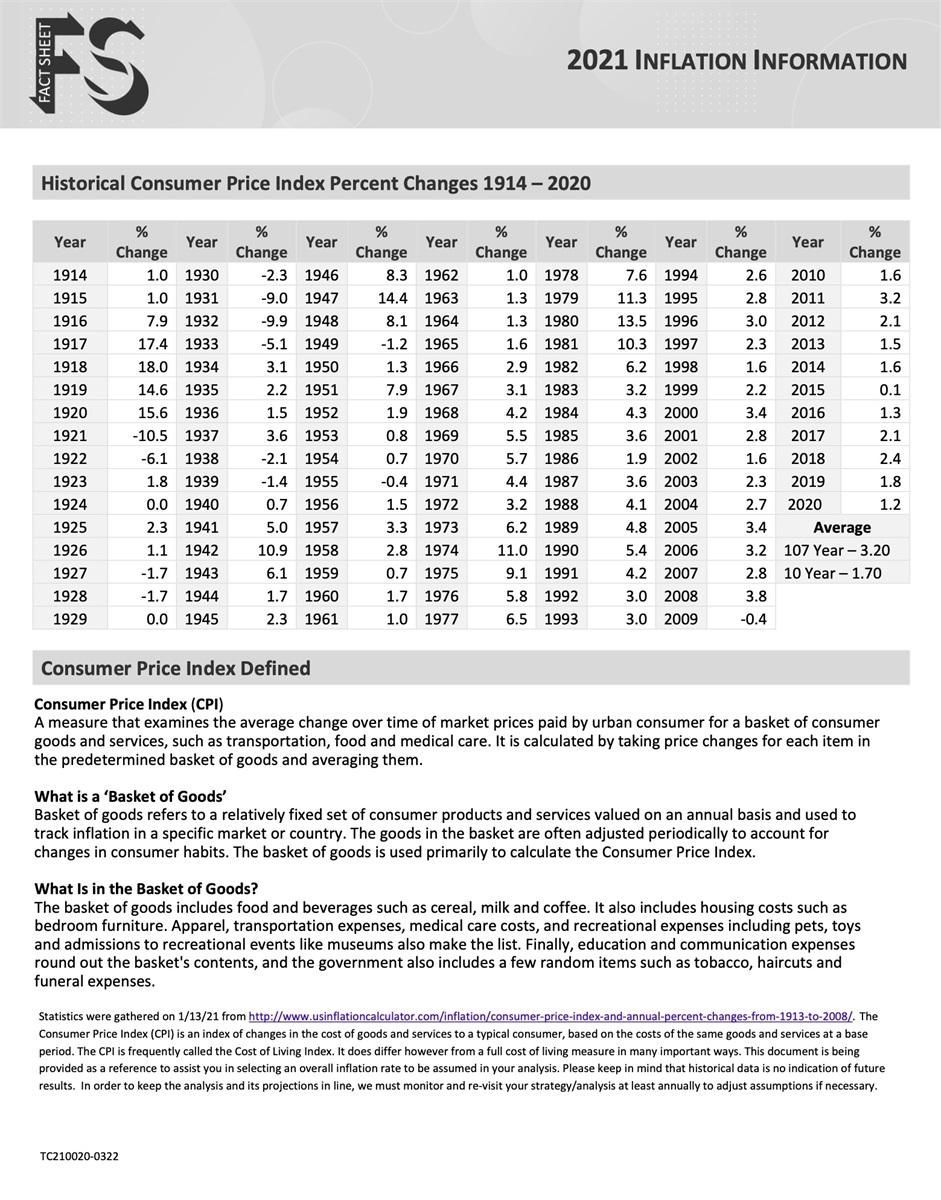

In October 2021, the annual inflation rate in the United States rose to 6.2%.** Last month’s inflation rate of 6.2% is staggeringly high compared to the 1.7% annual inflation rate for the past 10 years or even the 3.2% annual inflation rate over the last 107 years.*** The current rate of 6.2% is the highest since November 1991.

What does inflation mean for a saver and investor?

Inflation is the loss of purchasing power of money. As the cost of goods increase, it takes more money to buy the same products and services. Simply said, the dollar doesn’t buy as much as it used to. If you had $100 with a 6.2% rate of inflation, next year your $100 would only buy the equivalent of $94 worth of goods. You would need $106.20 to buy the same amount of goods as you bought in the previous year for $100.

To avoid losing purchasing power, you must grow your money at a rate that is equal or higher than inflation.

We have been in an artificially low interest-rate environment in recent years. Low interest rates means that you cannot invest safely in money market funds, saving accounts and CDs and keep pace with inflation. I could write an entire article on why we should not expect to see good interest rates in the foreseeable future, perhaps in our lifetimes. That is another story for another time.

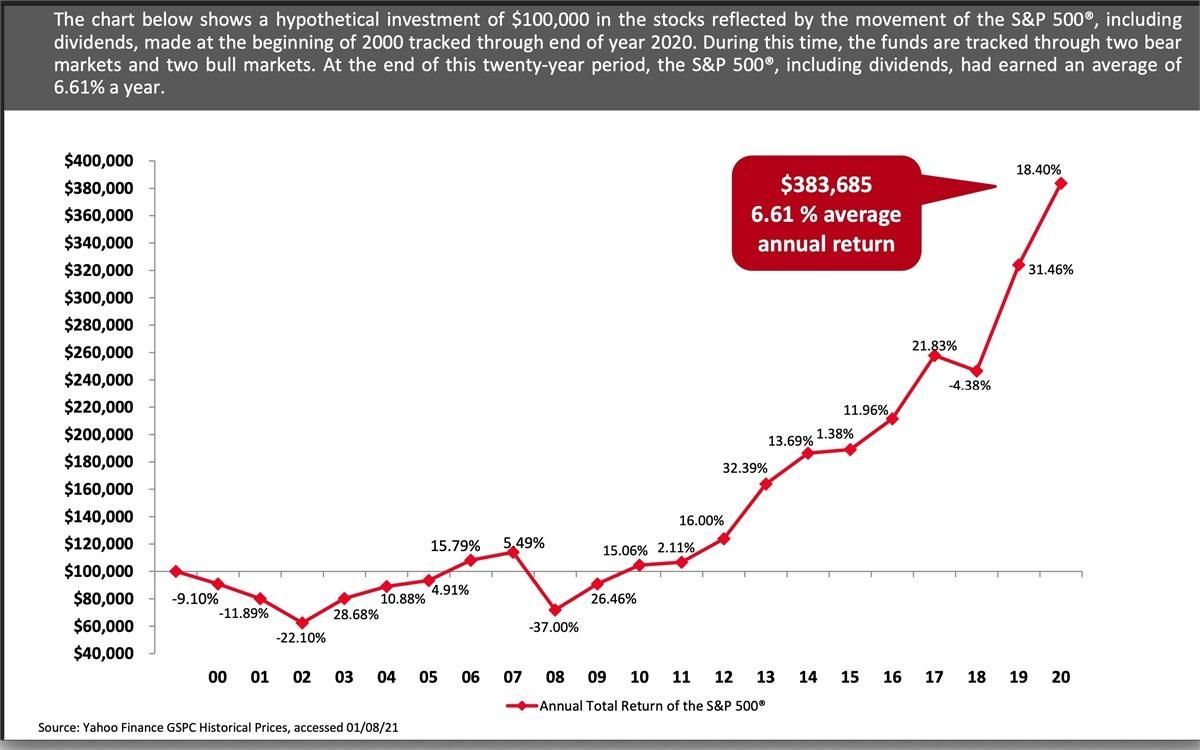

Many people will turn to less-safe market investments such as stocks and mutual funds to outgrow inflation. While we have seen amazing market growth in recent years, the average annual return on the S&P 500 has been 6.61% over the last twenty years. If inflation rates stay at 6.2%, investors would have to beat the market average over the last twenty years to avoid losing purchasing power.

Some people may consider index investments such as annuities and life insurance. These products offer less risk in exchange for limited growth potential, and they may outperform the market depending on market volatility. These types of investments often have specific purposes which may be excellent for some investors and detrimental to others.

Market volatility, rising inflation, and other economic conditions makes it more important than ever to work with a financial and investment professional who can help you create a holistic plan that addresses income risk, market risk, and tax risk.

Inflation can be a silent killer of savings. Inflation is usually a slow progression that you do not notice right away. By the time you feel a significant inflation impact to your savings and investments, you have already lost purchasing power and it may be more difficult to make financial and investment changes to compensate for the loss and keep pace with future inflation.

If you have never had a financial and investment plan, or if you are looking for a second opinion on your current plan, please give us a call at (502) 410-3465 or email us at info@wealthcareinvestments.com.

About Us

WealthCare Investments & Insurance, LLC is a client-focused firm. We have been able to make a difference in many peoples’ lives that we would never have met if it wasn’t for our clients who support and advocate us. For this reason, we choose to invest our time and resources back into our clients.

Contact Info

WealthCare Investment & Insurance is located at 6603 River Road, Prospect, KY 40059. Advisory services offered through American Capital Management (ACM), located at 4222 Grant Line Road, New Albany, IN 47150. All other products and services offered through WealthCare Investments & Insurance. Powered by Levitate.